U.S. Agricultural Import Values Outpaced Export Values in Fiscal Year 2023 by $16.7B

- by Sara VanderPoel

- Apr 8, 2024

- 2 min read

In the fiscal year 2023, the United States agricultural trade experienced a deficit, continuing a trend that has emerged in three out of the last five years. This shift is not merely a reflection of export competitiveness but rather a response to evolving consumer preferences and economic factors.

According to the USDA Economic Research Service (ERS), the deficit in FY 2023 amounted to $16.7 billion, primarily driven by increased imports of high-value items such as fruits, vegetables, and alcoholic beverages. In FY24, the USDA is estimating a $30.5B ag trade deficit.

The United States typically exports more agricultural goods by value than it imports, but the value of imports has grown more rapidly than exports over the past decade, contributing to a negative trade balance in some years. According to the USDA, "From fiscal years 2013 to 2023, U.S. agricultural exports expanded at a compound annual growth rate of 2.1 percent. During that same time, U.S. agricultural imports increased by 5.8 percent. The robust increase in U.S. demand for imports has been largely driven by the strong U.S. dollar and consumer preferences for year-round produce selections. The resulting agricultural trade balance was negative in 3 of the past 10 fiscal years."

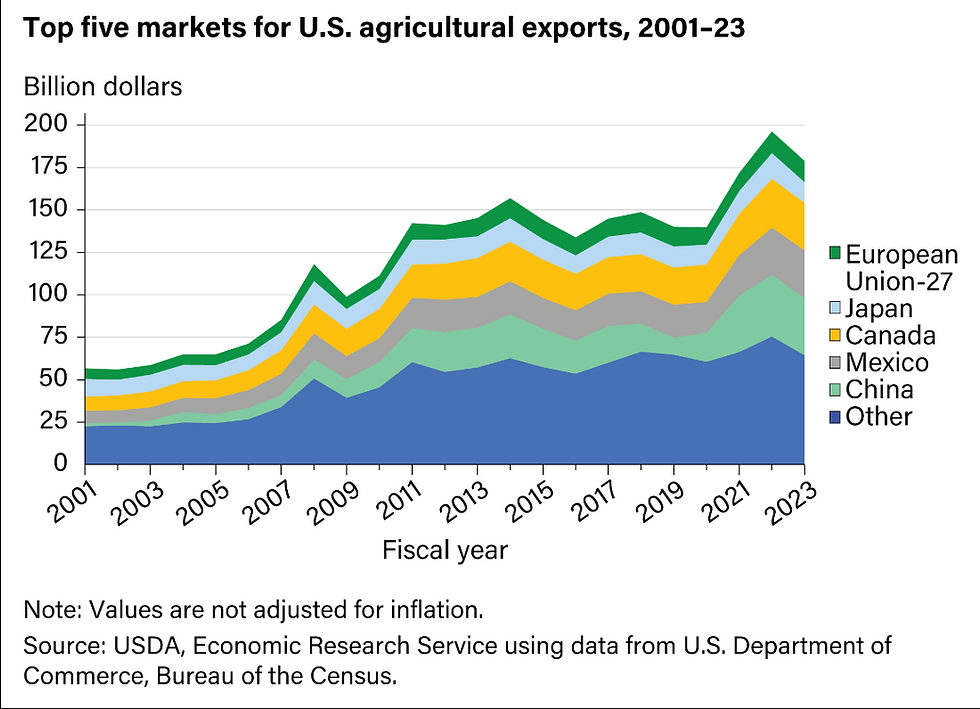

According to the USDA, "The top 5 markets for U.S. agricultural exports accounted for 64 percent of the total value of U.S. agricultural exports in fiscal year 2023. Exports to China were the largest share at $33.7 billion, followed by Mexico at $28.2 billion and Canada at $27.9 billion. The European Union trailed behind these numbers at $12.3 billion, slightly overtaking Japan at $12.2 billion. Since 2001, the nominal value of agricultural exports to these five U.S. trading partners increased annually by a compounded growth rate of 2.7 percent. From 2022 to 2023, the value of U.S. agricultural exports decreased to these markets, with the exception of Mexico."

The surge in consumer demand for imported goods, including those not readily available domestically, has contributed significantly to this expanding trade gap. Conversely, US agricultural exports, predominantly bulk commodities, have been subject to volatility influenced by global market dynamics.

"Diminishing access to foreign agricultural markets for U.S. industries creates significant economic headwinds and jeopardizes the livelihoods of more than one million American workers, farmers, and ranchers, as well as millions more U.S. jobs through the export supply chain." — U.S. senators in their letter to Tai and Vilsack.

Concerned senators sent a letter to U.S. Trade Rep Katherine Tai and Ag Secretary Tom Vilsack on March 13, 2024. In it, they demanded Tai and Vilsack provide a list of "specific actions" the Biden administration will take to elevate U.S. ag exports and if any new or improved free trade agreements will be put in place.